Content

First, which company is better able to pay off short-term debt for sure ? It’s surely Company X because Company X’s cash & cash equivalent is much more than Company Y compared to their respective current liabilities. And if we look at the ratio of both the companies, we would see that the ratio of Company X is 0.55, whereas the cash coverage ratio of Company Y is just 0.19. In the scenario above, the bank would want to run the calculation again with the presumed new loan amount to see how the company’s cash flows could handle the added load. Too much of a decrease in the coverage ratio with the new debt would signal a greater risk for late payments or even default. As with most liquidity ratios, a higher cash coverage ratio means that the company is more liquid and can more easily fund its debt.

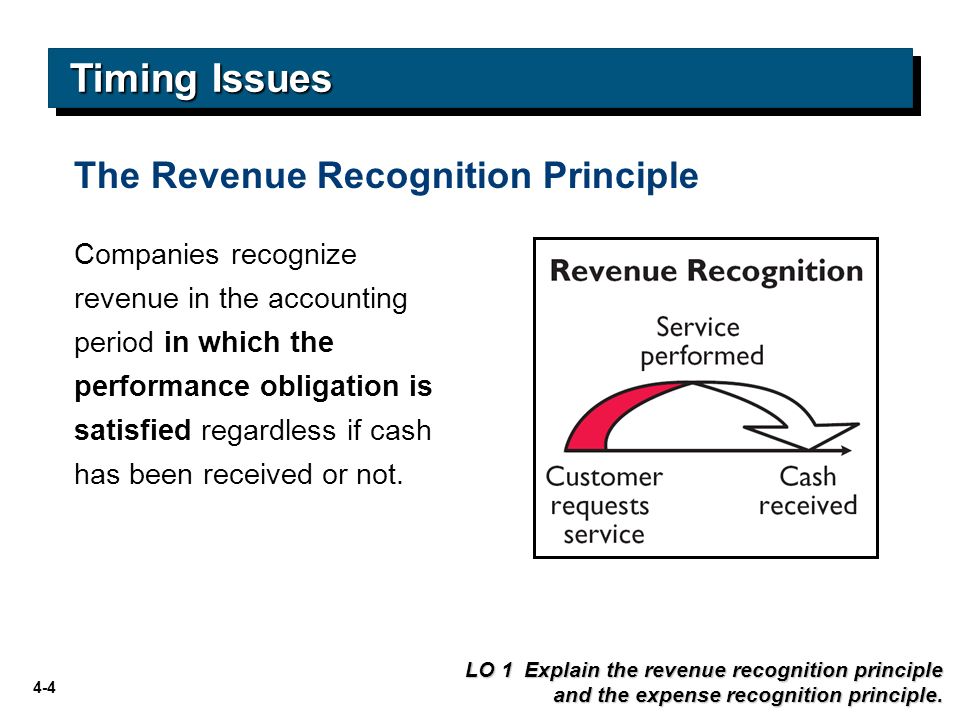

- Still, GAAP considers them as being equivalent to cash – hence the name – because there’s not a long process to them becoming actual cash.

- This is one more additional ratio, known as the cash coverage ratio, which is used to compare the company’s cash balance to its annual interest expense.

- If that were to happen, companies can immediately turn some particular assets they have into cash to save themselves.

- Such a situation means that the business cannot pay off its current debts since it cannot generate enough cash flow.

- It is unlikely that it will use its debt capital to clear a debt thus financing/investing cash flow doesn’t apply in calculating the ratio.

- The liquidity coverage ratio refers to the proportion of highly liquid assets held by financial institutions to ensure their ongoing ability to meet short-term obligations.

The ratio, classified under the head of liquidity ratios, ascertains the entity’s ability to cover its current accrued expenses with the cash flow received from its primary business. The cash flow coverage ratio shows the amount of money a company has available to meet current obligations. It is reflected as a multiple, illustrating how many times over earnings can cover current obligations like rent, interest on short term notes andpreferred dividends. Unlike other liquidity ratio measurement, the cash ratio forces strict evaluation, meaning only cash and cash equivalents—the most readily available—are taken into account to calculate the ratio. In other words, only the most liquid assets are taken into consideration instead of total assets. Not all assets owned by a company can be sold easily when the company needs to.

Calculation

For example, see Debt Yield — Everything Investors Need to Know and Cap Rate Simplified (+ Calculator). For instance, check out our articles on Hard vs Soft Money Loans and Preferred Equity — Everything Investors Need to Know. Debt service refers to the money that is required to cover the payment of interest and principal on a loan or other debt for a particular time period.

Want $500 in Quarterly Dividend Income? Invest $23600 in This … – Nasdaq

Want $500 in Quarterly Dividend Income? Invest $23600 in This ….

Posted: Mon, 30 Jan 2023 10:21:00 GMT [source]

It is important to monitor cash flow to enable financial health in the long-term and a company can do so by computing the cash flow coverage ratio. When used alongside indicators such as fixed charge coverage it can be vital especially for companies undergoing fast growth or those struggling with debt. Having a huge cash flow ratio means that the company generates a lot of cash from its operations. Some people refer to companies with high CFC ratios as cash cows. This means that they have huge amounts of cash to carry their operations. Banks will look at the cash flow coverage ratio to ascertain the loan repayment risk before lending a company some cash.

Understanding a Coverage Ratio

Ignoring these distinctions can lead to DSCR values that overstate or understate a company’s debt service capacity. The Pre-Tax Provision Method provides a single ratio that expresses overall debt service capacity reliably given these challenges. Risk exposure due to heavy short-term borrowing can be compensated for by _____. So, this has been stated before but, you could think of the cash flow coverage as your business’ safety net. By doing one of the equations detailed above, you will find out whether your company can still pay off its obligations or not. Having discussed the limitations, the cash ratio could be less useful than other liquidity ratios. But if you still want to check how much cash is lying around in your company, it’s good to use this guide to determine the cash ratio on your own.

Operating IncomeOperating Income, also known as EBIT or Recurring Profit, is an important yardstick of profit measurement and reflects the operating performance of the business. It doesn’t take into consideration non-operating gains or losses suffered by businesses, the impact of financial What is Cash Coverage Ratio? leverage, and tax factors. It is calculated as the difference between Gross Profit and Operating Expenses of the business. Additionally, a more conservative approach is used to verify, so the credit analysts calculate again using EBIT, along withdepreciationandamortization.

What is the formula for calculating the current cash debt coverage ratio?

This result means that the business in question can cover its interest expenses nearly 12 times over, leaving more than enough in cash to cover other obligations. A company having an interest expense of Rs. 89, non cash expenses of Rs. 153 and earnings before interest and taxes of Rs. 289. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Once all the forecasted years have been filled out, we can now calculate the three key variations of the interest coverage ratio. Therefore, the higher the number of “turns” for an interest coverage ratio, the more coverage , because there is more “cushion” in case the company underperforms.

From the above discussion, it’s clear that the cash coverage ratio could be one of the best-measuring grids of liquidity for a firm. But there are a few limitations of this ratio, which may become the reason for its infamous nature. Colgate has maintained a healthy ratio of 0.1x to 0.28x in the past ten years. With this higher cash ratio, the company https://online-accounting.net/ is better positioned to pay off its current liabilities. EarningsEarnings are usually defined as the net income of the company obtained after reducing the cost of sales, operating expenses, interest, and taxes from all the sales revenue for a specific time period. In the case of an individual, it comprises wages or salaries or other payments.